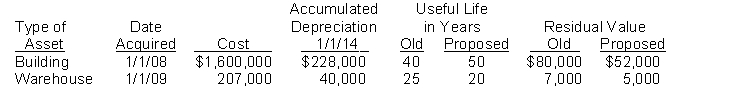

Steve White the new controller of Weinberg Company, has reviewed the expected useful lives and residual values of selected depreciable assets at the beginning of 2014. His findings are as follows.  All assets are depreciated by the straight-line method. Weinberg Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Steve's proposed changes.

All assets are depreciated by the straight-line method. Weinberg Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Steve's proposed changes.

Instructions

(a) Compute the revised annual depreciation on each asset in 2014. (Show computations.)

(b) Prepare the entry (or entries) to record depreciation on the building in 2014.

Definitions:

Taxable Income

The portion of income that is subject to income tax after all deductions and exemptions are applied.

Publicly-traded Domestic Corporation

A company whose shares are traded on a public stock exchange within the issuing country, subject to regulation and reporting requirements.

Dividend

A portion of a company's earnings distributed to shareholders, usually in the form of cash or additional shares.

Formation of Corporation

The process of legally establishing a business as a corporation, which involves filing necessary documents with a government entity and adhering to the required regulatory procedures.

Q2: The December 31, 2013 balance sheet of

Q24: On January 1, 2014, $4,000,000, 5-year, 10%

Q31: <sup> </sup>212. Presented here is a partial

Q58: The entry to replenish a petty cash

Q71: If the proceeds from the sale of

Q84: Which of the following would not be

Q114: Proper control for over-the-counter cash receipts includes<br>A)

Q138: <sup> </sup>191. ¥1 billion, 8%, 10-year bonds

Q158: Because cash is the least liquid current

Q208: All reconciling items in determining the adjusted