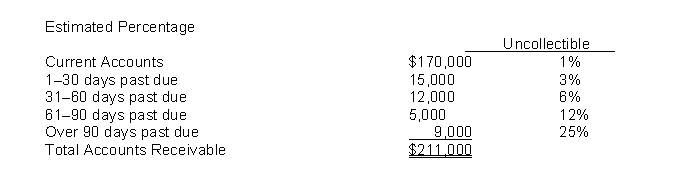

Moore Company had a $700 credit balance in Allowance for Doubtful Accounts at December 31, 2014, before the current year's provision for uncollectible accounts. An aging of the accounts receivable revealed the following:  Instructions

Instructions

(a) Prepare the adjusting entry on December 31, 2014, to recognize bad debts expense.

(b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $500 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting entry for the current year's provision for uncollectible accounts.

(c) Assume that the company has a policy of providing for bad debts at the rate of 1% of sales, that sales for 2014 were $500,000, and that Allowance for Doubtful Accounts had a $650 credit balance before adjustment. Prepare the adjusting entry for the current year's provision for bad debts.

Definitions:

Horizontal Equity

The principle that individuals with similar income or assets should be taxed at the same rate, reflecting fairness in tax policy.

Tax Policy

Refers to the principles and proposals governments use to design and implement taxes, affecting economic behavior, distribution of income, and fund public expenditures.

Income Quintile

A statistical measure dividing the population into five equal groups according to their income level to analyze economic inequality.

Lump-Sum Tax

A tax that is a fixed amount, not varying with the taxpayer’s income level or expenditure, making it independent of the taxpayer’s behavior.

Q41: Klosterman Corporation's unadjusted trial balance includes the

Q43: In order to accelerate the receipt of

Q53: Units-of-activity is an appropriate depreciation method to

Q63: Under the allowance method, Bad Debt Expense

Q141: An auto manufacturer would classify vehicles in

Q149: An asset that cannot be sold individually

Q163: A company just starting business made the

Q177: The daily cash count of cash register

Q214: The _ of an asset should not

Q263: If a retailer assesses a finance charge