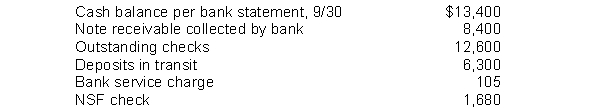

Jeter Company developed the following reconciling information in preparing its September bank reconciliation:  Using the above information, determine the cash balance per books (before adjustments) for the Jeter Company.

Using the above information, determine the cash balance per books (before adjustments) for the Jeter Company.

Definitions:

Adjusting Journal Entries

Entries made in account books at the end of an accounting period to allocate revenues and expenses to the period in which they actually occurred.

Ledger Accounts

Register that contains a record of all financial transactions categorized by account types within an organization's financial statements.

AASB 12/IFRS 12

An accounting standard that requires disclosures of interests in other entities, including subsidiaries, joint arrangements, associates, and unconsolidated structured entities.

Disclosure Requirements

Specific information that must be provided in financial statements or notes to the statements, ensuring transparency and completeness in financial reporting.

Q21: A company exchanged an old machine, which

Q64: An exception to disbursements being made by

Q93: For the current month, the beginning inventory

Q116: Personnel who handle cash receipts should have

Q126: Oliver Furniture factors $800,000 of receivables to

Q131: Which of the following statements is true

Q166: An error that overstates the ending inventory

Q181: Mishu Inc. uses the retail inventory method

Q209: When a note receivable is honored, Cash

Q226: The revenue recognition principle applies to merchandisers