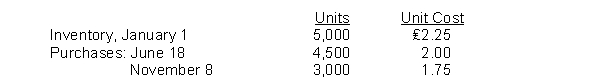

Holliday Company's inventory records show the following data:  A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for ₤3 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. Under the FIFO method, the December 31 inventory is valued at

A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for ₤3 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. Under the FIFO method, the December 31 inventory is valued at

Definitions:

Comparative Statement of Income

A financial statement presenting a company's revenues, expenses, and profits over multiple periods for comparison purposes.

Cash Basis

An accounting method where revenues and expenses are recognized only when cash is actually received or paid out, as opposed to when they are incurred.

Cost Of Goods Sold

Expenses directly linked to creating products sold by a business, which include labor and materials.

Cash Paid

Cash paid encompasses any outflow of cash from a company or individual for various purposes, including expenses, acquisitions, or investments.

Q9: Assuming a 360-day year, the maturity value

Q38: India Eastern Corporation's computation of cost of

Q84: Widner Company understated its inventory by $10,000

Q125: The consistent application of an inventory costing

Q150: A buyer would record a payment within

Q154: Operating expenses are different for merchandising and

Q158: Because cash is the least liquid current

Q197: On September 1, Reid Supply had an

Q219: The most efficient way to accomplish closing

Q237: Franco Company wrote checks totaling €37,090 during