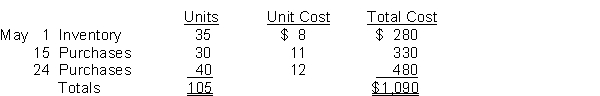

London Co. uses a periodic inventory system. Its records show the following for the month of May, in which 80 units were sold.  Instructions

Instructions

Compute the ending inventory at May 31 and cost of goods sold using the (1) FIFO and (2) LIFO methods. Prove the amount allocated to cost of goods sold under each method.

Definitions:

Null Hypothesis

A statement in statistical hypothesis testing that assumes no effect or no difference, used as a starting point for testing statistical significance.

Type I Error

The mistaken disapproval of a valid null hypothesis, commonly referred to as a "false positive."

Type II Error

The error that occurs when a false null hypothesis is not rejected, meaning a real effect or difference was missed.

Type I Error

The mistake of rejecting a true null hypothesis, or in other words, concluding that a difference or effect exists when it actually does not.

Q34: The ledger of Hunter Company contains the

Q47: Financial information is presented below for two

Q50: A €200 petty cash fund has cash

Q55: The following information (in thousands) is available

Q59: At December 31, 2014, Daewoo Inc. reported

Q107: Closing entries impact the income statement but

Q113: Under a periodic inventory system, freight-in on

Q170: The income statement for a merchandising company

Q186: The income statement for the year 2014

Q246: In a perpetual inventory system, the cost