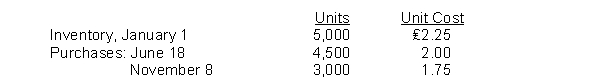

Holliday Company's inventory records show the following data:  A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for ₤3 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. Under the FIFO method, the December 31 inventory is valued at

A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for ₤3 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. Under the FIFO method, the December 31 inventory is valued at

Definitions:

Liability Accounts

Accounts on a balance sheet representing what a company owes to others, including loans, mortgages, and accounts payable.

Debits

Entries on the left-hand side of an accounting ledger, indicating increases in assets or expenses or decreases in liabilities or equity.

Transactions

Economic activities or events that affect the financial position of a company and can be quantified in monetary terms.

Journal Entries

Written records of all the financial transactions of a business, which are then used to prepare financial statements.

Q14: If a company deposits all its receipts

Q73: Every sales transaction should be supported by

Q79: Financial information is presented below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3135/.jpg"

Q97: Boyer Company applied FIFO to its inventory

Q102: A company's operating cycle and fiscal year

Q116: Personnel who handle cash receipts should have

Q119: If the inventory reported on the statement

Q178: Gross profit is obtained by subtracting _

Q199: Assume that Vangundy Company uses a periodic

Q215: Assuming that there is a net loss