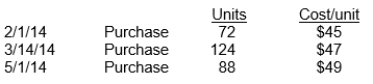

Lee Industries had the following inventory transactions occur during 2014:  The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

Definitions:

Final Selling Price

The final amount at which a product is sold to the consumer, including all discounts, offers, and added taxes.

Retailer's Cost

The total expenses incurred by a retailer in acquiring goods for sale, not just the purchase price, but also including shipping, storage, and other costs.

Brand-Name Merchandise

Products that are recognized and sold under a well-known, established brand name, often associated with higher quality and consumer trust.

Markdown Pricing Strategy

A pricing approach where products are initially offered at a higher price but are subsequently marked down, usually to stimulate sales or clear out inventory.

Q8: Firms use physical controls primarily to safeguard

Q38: To obtain maximum benefit from a bank

Q71: Stark Department Store estimates inventory by using

Q170: Compute the maturity date and the maturity

Q176: Using the allowance method, the uncollectible accounts

Q182: Hicks Company purchased merchandise from Beyer Company

Q185: Sampson Company's accounting records show the following

Q194: All of the following would be included

Q227: Maximum benefit from independent internal verification is

Q261: Charlie Co. lends Caroline Green Inc. $20,000