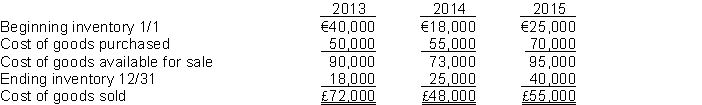

Speer's Hardware Store prepared the following analysis of cost of goods sold for the previous three years:  Net income for the years 2013, 2014, and 2015 was €70,000, €60,000, and €65,000, respectively. Since net income was consistently declining, Mr. Speer hired a new accountant to investigate the cause(s) for the declines.

Net income for the years 2013, 2014, and 2015 was €70,000, €60,000, and €65,000, respectively. Since net income was consistently declining, Mr. Speer hired a new accountant to investigate the cause(s) for the declines.

The accountant determined the following:

1. Purchases of €20,000 were not recorded in 2013.

2. The 2013 December 31 inventory should have been €21,000.

3. The 2014 ending inventory included inventory costing €8,000 that was purchased FOB destination and in transit at year end.

4. The 2015 ending inventory did not include goods costing €4,000 that were shipped on December 29 to Sampson Plumbing Company, FOB shipping point. The goods were still in transit at the end of the year.

Instructions

Determine the correct net income for each year. (Show all computations.)

Definitions:

Investing Activities

Transactions that involve the purchase or sale of long-term assets and other investments, typically reported on a company's cash flow statement.

Cash Dividend

A distribution of a portion of a company's earnings to its shareholders in the form of cash.

Financing Activities

Transactions between a company and its investors or creditors related to equity and debt, including issuing shares and obtaining loans.

Comparative Balance Sheet

A financial statement that presents the financial position of a company at two or more points in time, allowing for comparison and analysis of changes.

Q29: In a period of rising prices, FIFO

Q30: Under a perpetual inventory system, inventory shrinkage

Q44: Control over cash disbursements is improved if

Q79: Financial information is presented below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3135/.jpg"

Q93: The following information is for Acme Auto

Q138: The amounts appearing on an income statement

Q144: The trial balances of Barola Company follow

Q200: Tyler, Inc. had the following bank reconciliation

Q225: Under International Financial Reporting Standards (IFRS) operating

Q234: All of the following statements about the