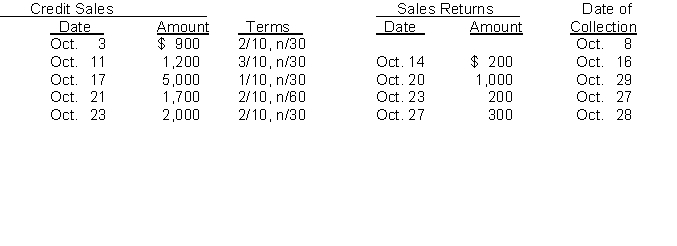

Newell Company completed the following transactions in October:  Instructions

Instructions

(a) Indicate the cash received for each collection. Show your calculations.

(b) Prepare the journal entry for the

(1) Oct. 17 sale. The merchandise sold had a cost of $3,500.

(2) Oct. 23 sales return. The merchandise returned had a cost of $140.

(3) Oct. 28 collection.

Newell uses a perpetual inventory system.

Definitions:

Federal Tax

Taxes imposed by the federal government on income, sales, imports, estates, and gifts, among others, to fund national programs and services.

Demand for Marijuana

The desire for and quantity of marijuana that consumers are willing and able to purchase at various prices.

Market

Any institution or mechanism that brings together buyers (demanders) and sellers (suppliers) of a particular good or service.

Exchange of Goods

The act of giving one thing and receiving another, especially of the same type or value, commonly referred to in the context of trade or barter.

Q8: Compute the lower-of-cost-or-net realizable value valuation for

Q17: Employees who handle cash should be _

Q24: What is Ling's 2013 net income using

Q55: The following information (in thousands) is available

Q121: Intangible assets are customarily the first items

Q158: At March 31, account balances after adjustments

Q158: The primary source of revenue for merchandising

Q173: In a period of rising prices, the

Q188: Joyce's Gifts signs a three-month note payable

Q204: A major advantage of LIFO is that