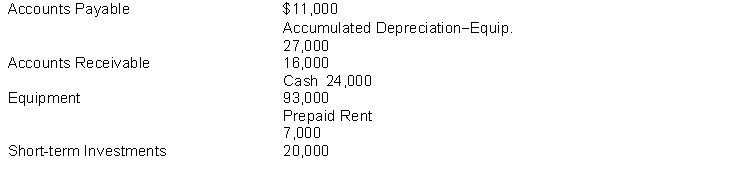

Compute the dollar amount of current assets based on the following account balances.

Definitions:

Mental Visualization

The process of creating or re-creating images, scenarios, or elements within the mind without direct input from the external senses.

Working Memory

A cognitive system with a limited capacity that is responsible for temporarily holding information available for processing and manipulation.

Explicit Memory

Retention of facts and experiences that we can consciously know and “declare.” (Also called declarative memory.)

Conscious Memory

memory that involves the awareness of remembering and which can typically be verbalized.

Q37: During August, 2014, Joe's Supply Store generated

Q39: The recording process becomes more efficient and

Q98: The income statement for the year 2014

Q103: Under International Financial Reporting Standards (IFRS) use

Q117: Omega Company pays its employees twice a

Q151: An accounting period that is one year

Q152: The adjustments entered in the adjustments columns

Q156: An accountant has debited an asset account

Q163: The statements of financial position of Claude

Q192: A company has purchased a trust of