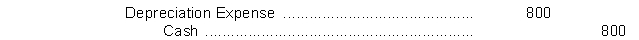

A new accountant working for Unitas Company records $800 Depreciation Expense on store equipment as follows:  The effect of this entry is to

The effect of this entry is to

Definitions:

Deferred Taxes

Taxes that are due on income or transactions that have been recorded in the financial statements but have not yet been settled in cash.

Tax Contingency Reserve

A tax contingency reserve is an accounting provision made to cover potential tax liabilities that may arise due to uncertainties in the interpretation of tax laws or disputes with tax authorities.

Earnings Quality

An assessment of the true income generated by a company, gauging how accurately the reported income reflects the company's true earning power.

Deferred Tax Assets

Assets on a company's balance sheet that may be used to offset future tax liabilities.

Q5: A numbering system for a chart of

Q11: The adjustments columns of the worksheet for

Q15: The statement of financial position is also

Q41: Richter Company sells merchandise on account for

Q47: An account is a part of the

Q48: Harrod's Inc. purchased land for ₤55,000 in

Q228: In developing an accounting information system, it

Q231: The following is selected information from Alpha-Beta-Gamma

Q267: Even though a partnership is not a

Q274: Which of the following adjustments would require