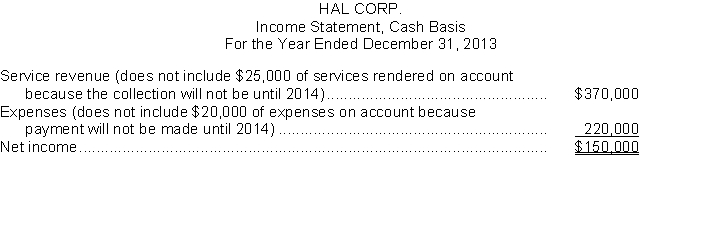

Hal Corp. prepared the following income statement using the cash basis of accounting:  Additional data:

Additional data:

1. Depreciation on a company automobile for the year amounted to $6,000. This amount is not included in the expenses above.

2. On January 1, 2013, paid for a two-year insurance policy on the automobile amounting to $2,400. This amount is included in the expenses above.

Instructions

(a) Recast the above income statement on the accrual basis in conformity with IFRS. Show computations and explain each change.

(b) Explain which basis (cash or accrual) provides a better measure of income.

Definitions:

Delaying Action

A tactic or strategy aimed at postponing something or slowing down an opposing force, often to gain more time for preparation or decision-making.

Conflict Buying Time

A strategy used in conflict resolution where time is intentionally taken before responding or making a decision, to allow for de-escalation and thoughtful consideration.

Defense Mechanism

Psychological strategies used unconsciously to protect oneself from anxiety arising from unacceptable thoughts or feelings.

Negativism

An aggressive mechanism in which a person responds with pessimism to any attempt at solving a problem.

Q46: The permanent accounts appear on which financial

Q51: Statement of financial position accounts are considered

Q70: Prepare the necessary adjusting entry for each

Q83: Jackson Cement Corporation reported $35 million for

Q111: Computing net income on the worksheet occurs

Q200: The following items (in thousands) are taken

Q236: Y-B-2 Inc. pays its rent of $60,000

Q250: Bread Basket provides baking supplies to restaurants

Q254: Rent received in advance and credited to

Q274: Which of the following adjustments would require