Selected transactions for Sweet Home, a property management company, in its first month of business, are as follows.

Jan. 2 Issued ordinary shares to investors for $15,000 cash.

3 Purchased used car for $4,000 cash for use in business.

9 Purchased supplies on account for $500.

11 Billed customers $1,800 for services performed.

16 Paid $200 cash for advertising.

20 Received $700 cash from customers billed on January 11.

23 Paid creditor $300 cash on balance owed.

28 Paid dividends of $2,000.

Instructions

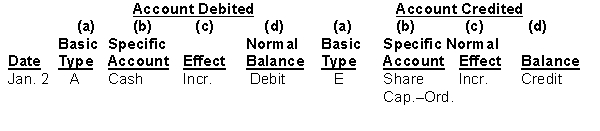

For each transaction indicate the following.

(a) The basic type of account debited and credited (asset (A), liability (L), equity (E)).

(b) The specific account debited and credited (cash, rent expense, service revenue, etc.).

(c) Whether the specific account is increased (incr.) or decreased (decr).

(d) The normal balance of the specific account.

Use the following format, in which the January 2 transaction is given as an example.

Definitions:

Revenue Journal

An accounting ledger that records all transactions involving the income earned by the business, specifically from its operations and activities.

Provided on Account

A transaction that occurs when goods or services are delivered with the understanding that payment will be made at a later date.

Creditor Balances

The amounts owed by a business to its creditors, representing liabilities for goods, services, or loans provided to the business.

Cash Payments Journal

An accounting ledger that tracks all cash outflows or payments made by a business.

Q48: An account will have a credit balance

Q67: The standard format of a journal would

Q140: The tax that is paid equally by

Q146: Transactions for Tom Petty Company for the

Q196: Which of the statements below is not

Q198: The primary purpose of the statement of

Q207: A subsidiary ledger is<br>A) used in place

Q209: A business whose owners enjoy limited liability

Q232: Current assets under GAAP are listed generally<br>A)

Q269: When companies record transactions in the period