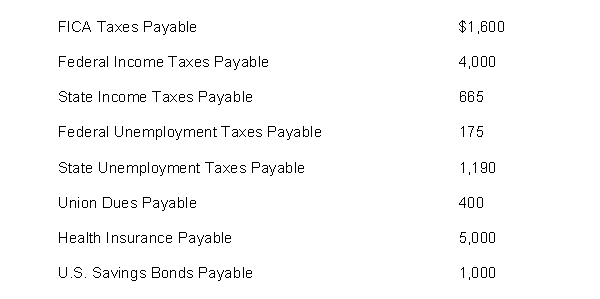

The following payroll liability accounts are included in the ledger of Clementine Company on January 1, 2014:  In January, the following transactions occurred:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,600 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Purchased U.S. Savings Bonds for employees by writing a check for $1,000.

Instructions

Journalize the January transactions

Definitions:

Efficacy Judgments

Assessments or beliefs regarding one's own ability to execute behaviors necessary to produce specific performance attainments.

Performance Attainment

The achievement level an individual reaches after a period of learning or practice, often measured against predetermined standards.

Influential Model

A person or theory that shapes or significantly affects the thoughts, behaviors, or attitudes of others.

Important Values

Core beliefs or standards that guide and motivate attitudes and actions in individuals.

Q5: A firm that employs an aggressive working

Q7: Preferred stock typically has a par value,

Q8: A cash receipts journal can be used

Q27: DSO analysis of accounts receivable is the

Q53: In a financial merger, the relevant post-merger

Q88: Bennoit Corporation paid dividends totaling €295,000 to

Q99: Marin Company sells 9,000 units of its

Q195: On its December 31, 2014 statement of

Q247: As of June 30, 2014, Dallas Company

Q278: If a transaction cannot be recorded in