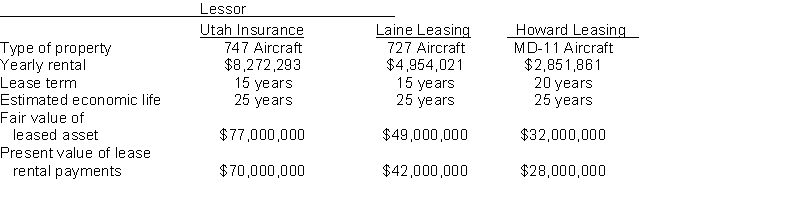

Presented below are three different aircraft lease transactions that occurred for Western Airways in 2014. All the leases start on January 1, 2014. In no case does Western receive title to the aircraft during or at the end of the lease period; nor is there a bargain purchase option.  Instructions

Instructions

(a) Which of the above leases are operating leases and which are finance leases? Explain your answer.

(b) How should the lease transaction with Utah Insurance be recorded in 2014?

(c) How should the lease transaction with Laine Leasing be recorded in 2014?

Definitions:

Unconscious Thoughts

Mental processes that occur without conscious awareness, influencing behavior, perceptions, and emotions.

Psychoanalysis

A therapeutic approach founded by Sigmund Freud that seeks to explore the unconscious mind to uncover repressed thoughts and feelings affecting current behavior.

Free Associate

A psychoanalytic technique where a patient is asked to share thoughts, words, or images as they come to mind, without censorship or selection.

Psychoanalysis

A therapeutic technique and theory of psychopathology, originating with Sigmund Freud, focused on unconscious motives and conflicts.

Q12: Seligstine, Inc.'s DSO was 31 days in

Q13: Which of the following has to do

Q18: What would be the cost to Berkeley

Q19: Bass Boats Inc. currently has sales of

Q41: Offering trade credit discounts is costly to

Q48: Which of the following statements is most

Q119: In managing a firm's accounts receivable it

Q136: Identify the accounts to be debited and

Q180: Sasser Company uses a sales journal, a

Q281: The future value of 1 factor will