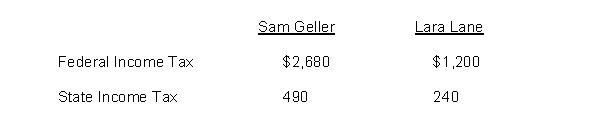

Sam Geller had earned (accumulated) salary of $99,000 through November 30. His December salary amounted to $9,000. Lara Lane began employment on December 1 and will be paid her first month's salary of $6,000 on December 31. Income tax withholding for December for each employee is as follows:  The following payroll tax rates are applicable:

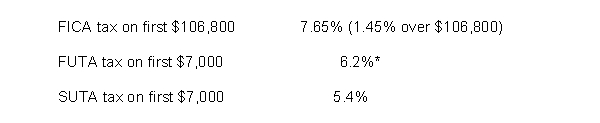

The following payroll tax rates are applicable:  *Less a credit equal to the state unemployment contribution

*Less a credit equal to the state unemployment contribution

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll.

Definitions:

Weekly Pay

Compensation paid to employees on a weekly basis.

Hourly Rate

The amount of money paid for each hour of work, commonly used for calculating wages of part-time or contract employees.

Gross Pay

The total amount earned by an employee before any deductions or taxes are applied.

FICA-OASDI

Federal Insurance Contributions Act - Old Age, Survivors, and Disability Insurance, a U.S. payroll tax to fund Social Security.

Q20: If you receive some goods on April

Q33: If $40,000 is deposited in a savings

Q37: Which of the following statements is false?<br>A)

Q45: Net income for the period is determined

Q65: Determination of a firm's investment in net

Q65: During an accounting period, a business has

Q178: Posting of journal entries should be done

Q200: Accountants record both internal and external transactions.

Q211: The framework used to record and summarize

Q279: Warranty expenses are reported on the income