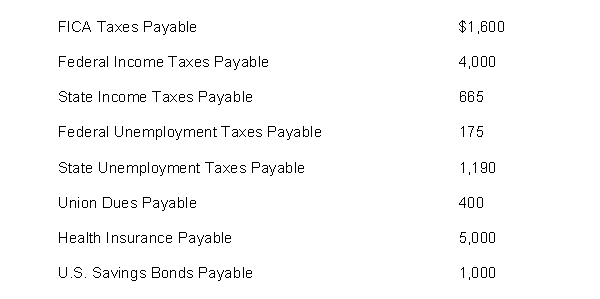

The following payroll liability accounts are included in the ledger of Clementine Company on January 1, 2014:  In January, the following transactions occurred:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,600 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Purchased U.S. Savings Bonds for employees by writing a check for $1,000.

Instructions

Journalize the January transactions

Definitions:

Farm Land

Land that is used for agricultural purposes, such as growing crops and rearing livestock.

Supply of Corn

The total amount of corn that producers are willing and able to sell at a given price level in a specific period.

Government Subsidies

Financial assistance provided by the government to support businesses, individuals, or economic sectors.

Ethanol

A volatile, flammable, colorless liquid commonly used as a fuel additive and in alcoholic beverages.

Q6: Bankruptcy plays no role in settling labor

Q9: Which of the following is not correct?<br>A)

Q72: Warren Company's payroll for the week ending

Q74: The calculated cost of trade credit is

Q78: If a firm has a large percentage

Q159: A classmate is considering dropping his accounting

Q169: At June 1, 2014, Estrada Industries had

Q176: As of December 31, 2014, Oxford-welsh Inc.

Q212: On December 1, the accounts receivable control

Q243: A good internal control feature is to