30

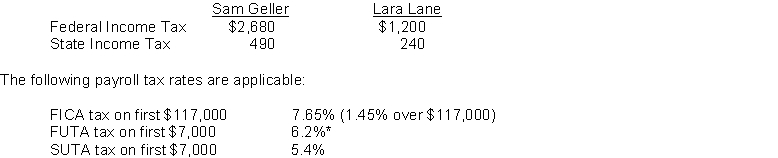

Sam Geller had earned (accumulated) salary of $110,000 through November 30. His December salary amounted to $9,800. Lara Lane began employment on December 1 and will be paid her first month's salary of $6,000 on December 31. Income tax withholding for December for each employee is as follows:  *Less a credit equal to the state unemployment contribution

*Less a credit equal to the state unemployment contribution

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll.

Definitions:

Q1: Which of the following is generally NOT

Q7: During times of inflation, which of these

Q9: Fullerton Wine Company is a retailer which

Q12: Company A can issue floating-rate debt at

Q13: Which of the following has to do

Q13: Sam Dryer owns and operates Sam's Burgers,

Q41: Entries in a sales journal<br>A) are made

Q63: A promissory note is the document signed

Q116: Marin Company sells 9,000 units of its

Q257: Which of the following items would not