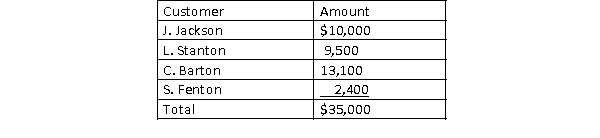

Morry Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31:

Required:  1) Journalize the write-offs for the current year under the direct write-off method.

1) Journalize the write-offs for the current year under the direct write-off method.

2) Journalize the write-offs for the current year under the allowance method. Also, journalize the adjusting entry for uncollectible receivables assuming the company made $2,400,000 of credit sales during the year and the industry average for uncollectible receivables is 1.50% of credit sales.

3) How much higher or lower would Morry Company's net income have been under the direct write-off method than under the allowance method?

Definitions:

Obedience

The act of following orders or directives from an authority figure, even if they are against one's personal wishes.

Authority

The power or right to give orders, make decisions, and enforce obedience.

Heterosexual Couples

Partnerships or pairings consisting of one male and one female who are romantically and/or sexually attracted to individuals of the opposite sex.

Altruistic Behavior

Selfless actions or behavior aimed at benefiting others without expecting anything in return.

Q6: All bank memos reported on the bank

Q26: A number of major structural repairs completed

Q66: Money orders are considered cash.

Q77: A voucher is a form on which

Q95: Minerals removed from the earth are classified

Q113: According to a summary of the payroll

Q149: Costs of government permits required to develop

Q158: Allowance for Doubtful Accounts has a credit

Q168: Which of the following are criteria for

Q190: Which of the following is included in