On January 1, Year 1, a company had the following transactions:

- Issued 10,000 shares of $2.00 par common stock for $12.00 per share.

- Issued 3,000 shares of $50 par, 6% cumulative preferred stock for $70 per share.

- Purchased 1,000 shares of previously issued common stock for $15.00 per share.

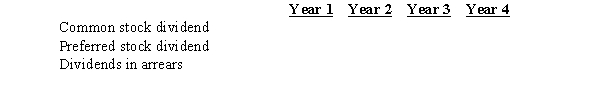

The company had the following dividend information available:

Year 1 - No dividend paid

Year 2 - Paid a $2,000 total dividend Year 3 - Paid a $20,000 total dividend Year 4 - Paid a $25,000 total dividend

Using the following format, fill in the correct values for each year:

Definitions:

Relevant

Pertains to information or costs that are pertinent to a particular decision, differing under the alternatives being considered.

Financial Advantage

The benefit derived from making a financial decision that results in gains exceeding costs.

New Product

An item recently introduced to the market that has not previously been available for purchase by consumers.

Joint Process

A manufacturing operation that produces multiple products simultaneously from the same process or raw materials, often seen in industries like chemicals or agriculture.

Q9: Payroll taxes only include social security taxes

Q23: The amount borrowed is equal to the

Q48: An interest-beating note is a loan in

Q74: Cash paid to purchase long-term investments would

Q127: The income statement for Dodson Corporation reported

Q151: An aid in internal control over payrolls

Q152: Sadie White receives an hourly rate of

Q172: $150,000<br>A) Treasury stock<br>B) Retained earnings<br>C) Preferred stock<br>D)

Q178: Solare Company acquired mineral rights for $60,000,000.

Q190: The accounting for defined benefit plans is