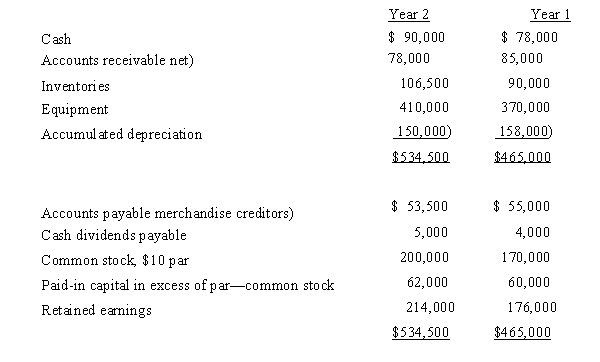

On the basis of the following data for Garrett Co. for Years 1 and 2 ended December 31, prepare a statement of cash flows using the indirect method of reporting cash flows from operating activities. Assume that equipment costing $125,000 was purchased for cash and equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000; that the stock was issued for cash; and that the only entries in the retained earnings account were for net income of $56,000 and cash dividends declared of $18,000.

Definitions:

Negotiable Instrument

A written document guaranteeing the payment of a specific amount of money, either on demand or at a set time, with the payee's name on it.

Rubber-stamped Signature

A term used to describe a signature that has been mechanically or electronically duplicated, often used to expedite document processing.

Drawer

The party in a financial transaction who writes and signs a check or draft directing a bank to pay the check’s amount to someone else.

Negotiable Instrument

A negotiable instrument is a signed document promising to pay the bearer or assigned holder a specific sum of money, such as checks, promissory notes, and drafts.

Q8: Percentage analyses, ratios, turnovers, and other measures

Q35: A common measure of liquidity is<br>A) the

Q52: If a gain of $11,000 is realized

Q66: debt and equity securities purchased and sold

Q138: When a bond is purchased for an

Q139: The account Unrealized Gain Loss) on Available-for-Sale

Q140: A receiving report is prepared when purchased

Q149: Managerial accounting information includes both historical and

Q163: Managerial accountants could prepare all of the

Q168: A ten-year bond was issued at par