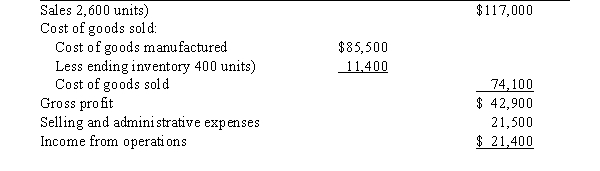

On October 31, the end of the first month of operations, Morristown & Co. prepared the following income statement based on absorption costing:

Morristown & Co.

Absorption Costing Income Statement

For Month Ended October 31, 20-  If the fixed manufacturing costs were $42,900 and the variable selling and administrative expenses were $14,600, prepare an income statement using variable costing.

If the fixed manufacturing costs were $42,900 and the variable selling and administrative expenses were $14,600, prepare an income statement using variable costing.

Definitions:

Company Tax Rate

The percentage of a company's taxable income that it must pay to the government as tax, varying across jurisdictions and influenced by specific tax laws and regulations.

Intragroup Sale

Transactions involving the exchange of goods or services between entities within the same group of companies.

Consolidation Worksheet

A tool used in accounting to merge the financial statements of a parent company and its subsidiaries.

Inventories

Resources allocated for trading within normal business practices, including those being prepared for sale or as materials and supplies meant for depletion during production or in service rendering.

Q32: The fact that workers are unable to

Q41: In contribution margin analysis, the quantity factor

Q47: If sales total $2,000,000, fixed costs total

Q57: A budget can be an effective means

Q59: Currently attainable standards do not allow for

Q64: Calculate the direct materials price variance.<br>A) $1,795.50

Q127: A firm operated at 80% of capacity

Q129: The most effective means of presenting standard

Q130: Assume that Corn Co. sold 8,000 units

Q190: Zipee Inc.'s unit selling price is $90,