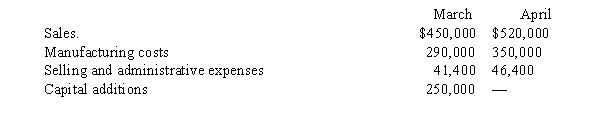

The treasurer of Calico Dreams Company has accumulated the following budget information for the first two months of the coming fiscal year:  The company expects to sell about 35% of its merchandise for cash. Of sales on account, 80% are collected in full in the month of the sale, and the remainder in the month following the sale. One-fourth of the manufacturing costs are paid in the month in which they are incurred, and the other three-fourths in the following month. Depreciation, insurance, and property taxes represent $6,400 of the monthly selling and administrative expenses. Insurance is paid in February, and property taxes are paid yearly in September. A $40,000 installment on income taxes is to be paid in April. Of the remainder of the selling and administrative expenses, one-half are to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are paid in March.

The company expects to sell about 35% of its merchandise for cash. Of sales on account, 80% are collected in full in the month of the sale, and the remainder in the month following the sale. One-fourth of the manufacturing costs are paid in the month in which they are incurred, and the other three-fourths in the following month. Depreciation, insurance, and property taxes represent $6,400 of the monthly selling and administrative expenses. Insurance is paid in February, and property taxes are paid yearly in September. A $40,000 installment on income taxes is to be paid in April. Of the remainder of the selling and administrative expenses, one-half are to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are paid in March.

Current assets as of March 1 are composed of cash of $45,000 and accounts receivable of $51,000. Current liabilities as of March 1 are accounts payable of $121,500 $102,000 for materials purchases and $19,500 for operating expenses). Management desires to maintain a minimum cash balance of $25,000.

Prepare a monthly cash budget for March and April.

Definitions:

Depreciation Expense

The allocation of the cost of a tangible fixed asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Interest Expense

Expenses related to borrowed capital for an entity, which includes loans, bonds, and lines of credit.

Prior Year

Refers to the accounting period immediately preceding the current period, often used for comparative financial analysis.

Common Stockholders' Equity

The portion of equity ownership in a corporation that belongs to common shareholders, including retained earnings and contributed capital.

Q26: Differential revenue is the amount of income

Q31: What is the budgeted unit of production

Q46: When using the product cost concept of

Q82: In a cost-volume-profit chart, the<br>A) total cost

Q85: Tucker Company produced 8,900 units of product

Q130: What is the rate of return on

Q156: In contribution margin analysis, the unit price

Q156: Given the following cost and activity

Q157: A company's history indicates that 20% of

Q183: The materials used by the Holly Company's