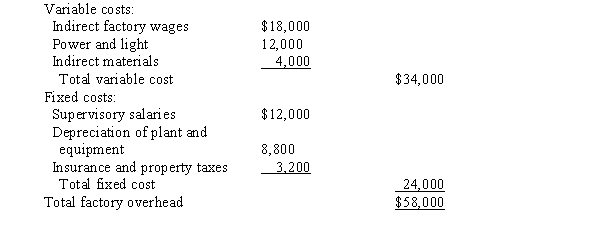

The Finishing Department of Pinnacle Manufacturing Co. prepared the following factory overhead cost budget for October of the current year, during which it expected to operate at a 100% capacity of 10,000 machine hours.  During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.

During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.

Prepare a factory overhead cost variance report for October. The budgeted amounts for actual amount produced should be based on 9,000 machine hours).

Definitions:

Calendar Time

The concept of time as measured by calendar units, such as days, months, and years, used in planning and scheduling.

Long Run

An economic phase where all elements of production and expenses can fluctuate, enabling complete adaptation to any alterations.

Normal Profit

The minimum profit necessary for a company to remain competitive in the market, equating to the opportunity cost of capital and resources.

Implicit Costs

Indirect expenses that do not involve a direct cash outlay but represent an opportunity cost, such as using resources for one purpose over another.

Q25: For short-run production planning, information in the

Q47: When budget goals are set too tight,

Q74: Lockrite Security Company manufacturers home alarms. Currently,

Q81: The first budget customarily prepared as part

Q86: Production and sales estimates for April are

Q96: A company is considering the purchase of

Q119: Which of the following is not a

Q124: A company records inventory purchases at standard

Q133: A variant of fiscal-year budgeting whereby a

Q156: In contribution margin analysis, the unit price