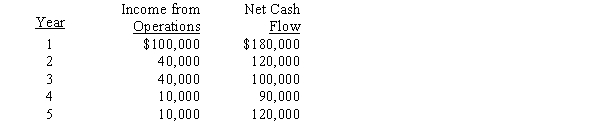

The management of Nebraska Corporation is considering the purchase of a new machine costing $490,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for Years 1 through 5 are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability:

-The cash payback period for this investment is

Definitions:

Q32: Lean manufacturing favors organizing work around products

Q52: Delaney Company is considering replacing equipment which

Q115: The minimum accepted divisional income from operations

Q120: If in evaluating a proposal by use

Q129: Which of the following is a measure

Q154: What additional information is needed to calculate

Q159: Paduka Industries has several divisions. The Eastern

Q160: By using the rate of return on

Q166: A company is contemplating investing in a

Q185: The anticipated purchase of a fixed asset