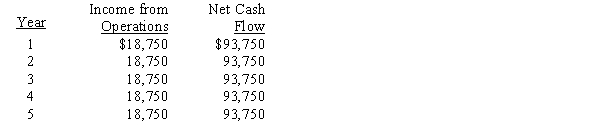

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The present value index for this investment is

Definitions:

Extensive Problem Solving

A consumer decision-making process used in situations involving high involvement and significant differences among brands.

Automatic Purchase

Buying decisions made with little conscious thought, often because of habit or brand loyalty.

Automaticity

The ability to perform actions without conscious thought or intention, achieved through repeated practice and learning.

Decision Habit Strength

The extent to which an individual's decisions are influenced by ingrained habits, often bypassing deliberative thought processes.

Q22: The markup percentage on total cost for

Q43: Crane Company Division B recorded sales of

Q46: In net present value analysis for a

Q73: The balanced scorecard measures<br>A) only financial information<br>B)

Q85: Lean manufacturing is also called make-to-stock manufacturing.

Q89: In a lean environment, the journal entry

Q108: If the profit margin for a division

Q125: The product cost concept includes all manufacturing

Q131: A cost that will not be affected

Q137: The differential revenue of producing Product P