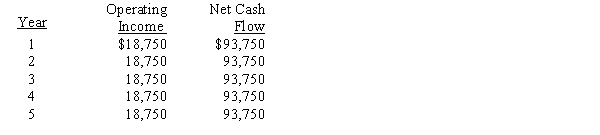

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-Motel Corporation is analyzing a capital expenditure that will involve a cash outlay of $208,240. Estimated cash flows are expected to be $40,000 annually for 7 years. The present value factors for an annuity of $1 for 7 years at interest of 6%, 8%, 10%, and 12% are 5.582, 5.206, 4.868, and 4.564, respectively. The internal rate of return for this investment is

Definitions:

APA Guidelines

A set of rules and standards for writing and formatting documents in psychology and related fields, established by the American Psychological Association.

Figure Creation

The process of designing and producing visual representations of data or concepts, often for analysis or presentation purposes.

X and Y Axes

The horizontal (X-axis) and vertical (Y-axis) lines on a graph that form the framework for plotting data points.

Variability

The degree to which data points in a statistical distribution or dataset differ from each other.

Q1: From the above schedule of activity costs,

Q3: What is the differential cost from the

Q20: Explain the law of demand. What does

Q31: Assume that you have heard news that

Q41: List and describe four fields of economics.

Q45: Mexico has lower wages than the United

Q48: The expected average rate of return for

Q49: What cost concept used in applying the

Q102: If the budget estimates that a desk

Q111: Methods that ignore present value in capital