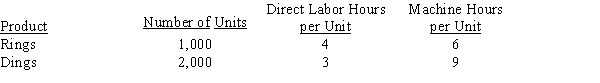

Aleutian Company produces two products: Rings and Dings. They are manufactured in two departments: Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $90,000. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $105,000.Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours.

All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $90,000. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $105,000.Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours.

-All of the following can be used as an allocation base for calculating factory overhead rates except

Definitions:

Average Variable Cost

The total variable cost divided by the quantity of output produced; it represents the variable cost per unit of output.

Marginal Cost

The incremental cost associated with the production of an additional unit of a product or service.

Total Costs

The complete expenses incurred in the process of producing or providing goods and services, including both fixed and variable costs.

Break Even

The point at which total costs and total revenues are equal, resulting in no net loss or gain.

Q1: In the figure below, is the slope

Q16: Susie receives an allowance from her parents

Q23: If crime rates in the United States

Q26: Explain how it is possible for marginal

Q34: Bob's Biscuit Corporation budgeted $1,200,000 of factory

Q42: In what ways can expectations change your

Q118: A project is estimated to cost

Q128: Which of the following is a measure

Q175: Differential analysis can aid management in making

Q186: A qualitative characteristic that may impact upon