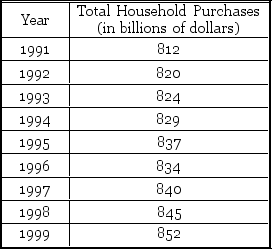

Create a time series graph with the data in the table below:

Definitions:

Forgotten Period

A term that is not clearly defined in the context of psychological or medical terminology; could refer to amnesia or a phase of life not remembered, but without a specific definition.

Stress Response

The body's reaction to a perceived threat or challenge, involving physiological and psychological changes.

Sympathetic Nervous System

The nerve fibers of the autonomic nervous system that quicken the heartbeat and produce other changes experienced as arousal and fear. One of the two major routes by which the brain and body produce arousal and fear.

Parasympathetic Nervous System

The nerve fibers of the autonomic nervous system that help return bodily processes to normal.

Q11: Financial accounting information is used more often

Q12: Explain how it might be possible to

Q18: Suppose that macaroni and cheese is an

Q36: Rent control is typically imposed ostensibly for

Q40: Colleges and universities often do not pay

Q57: Suppose a movie theater raises its ticket

Q59: Graph the following equation and then calculate

Q117: If in evaluating a proposal by use

Q133: Vendor quality<br>A)Preventive costs<br>B)Appraisal costs<br>C)Internal failure costs<br>D)External failure

Q171: A project has estimated annual cash