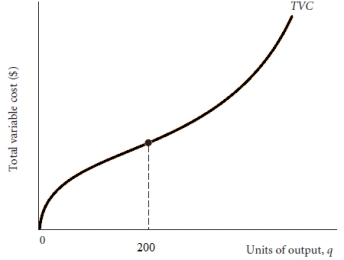

Using the graph below draw a marginal cost curve that would likely be the result. Use the output level of 200 as a reference point and explain why you drew it the way you did.

Definitions:

Complex Sentence Structures

Sentences that contain multiple clauses, often involving various subordinations and coordinations, to convey intricate ideas or relationships.

Independent Clause

A sentence component that expresses a complete idea, equipped with both subject and predicate, and can stand independently.

Redundant Word

Extra or surplus words that are not necessary for the clear expression of an idea in writing or speech.

Roundabout Construction

The process of building a circular intersection that directs traffic in one direction around a central island to improve flow and safety.

Q19: Assume there is a toll bridge that

Q21: Design engineering<br>A)Value-added<br>B)Non-value-added

Q24: When is the price of a product

Q30: It is often argued that gas stations

Q34: Explain how the price system eliminates a

Q35: You are a major stockholder of a

Q37: Comment on the following statement: "When a

Q38: List three key reasons to study economics.

Q45: What is venture capital?

Q46: What is the primary source for capital