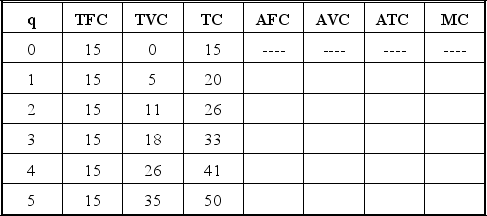

Martin's Barber Shop faces the following schedule for producing haircuts:

Fill in the columns for average fixed cost, average variable cost, average total cost, and marginal cost.

Fill in the columns for average fixed cost, average variable cost, average total cost, and marginal cost.

Definitions:

Contribution Approach

An income statement format that organizes costs by their behavior. Costs are separated into variable and fixed categories rather than being separated into product and period costs for external reporting purposes.

Manufacturing Overhead

All indirect costs related to manufacturing that cannot be directly traced to specific items produced, such as factory rent, utilities, and equipment depreciation.

Variable Costing

An accounting approach that only considers variable costs—costs that change with the level of output—in product costing and decision-making.

Absorption Costing

A financial technique that encompasses all costs associated with manufacturing (including both fixed and variable expenses) in the pricing of a product.

Q14: What does it mean for a good

Q15: Papa Ray owns a pizzeria. He is

Q16: Compare perfect competition and monopolistic competition. In

Q17: When the price of good X rises,

Q27: How is average total cost calculated? If

Q29: Observe the difference in vending machines between

Q30: Explain what post hoc fallacy means and

Q38: Suppose that the equilibrium rent for a

Q56: Most economists will argue that the minimum

Q92: From the foregoing information, determine the amount