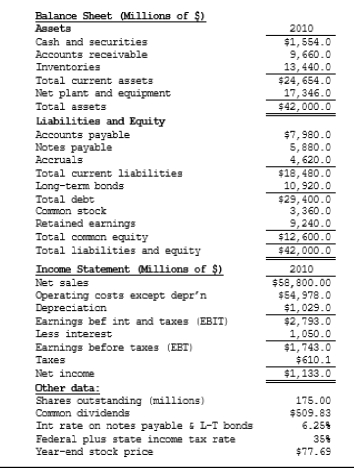

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-What is the firm's profit margin?

Definitions:

Expected Rate of Return

The anticipated return on an investment, considering both the probability and the amount of potential returns.

Total Investment

The sum of all expenditures on physical assets, financial assets, and other types of investments within a specified period.

Expected Rate of Return

The anticipated percentage of gain or loss that an investment is projected to generate over a specified period, accounting for all known risks.

Total Investment

The sum of all expenditures on capital assets, such as buildings, equipment, and inventories, over a specific period.

Q9: Retained earnings is affected by each of

Q9: In general, firms should use their weighted

Q9: Two disadvantages of a proprietorship are (1)

Q10: No entries are made in the Posting

Q17: Consists of the three basic accounting elements:

Q18: Which of the following would not be

Q32: You recently sold 100 shares of your

Q64: The fact that each transaction has a

Q76: Assume that Kish Inc. hired you as

Q90: Sapp Trucking's balance sheet shows a total