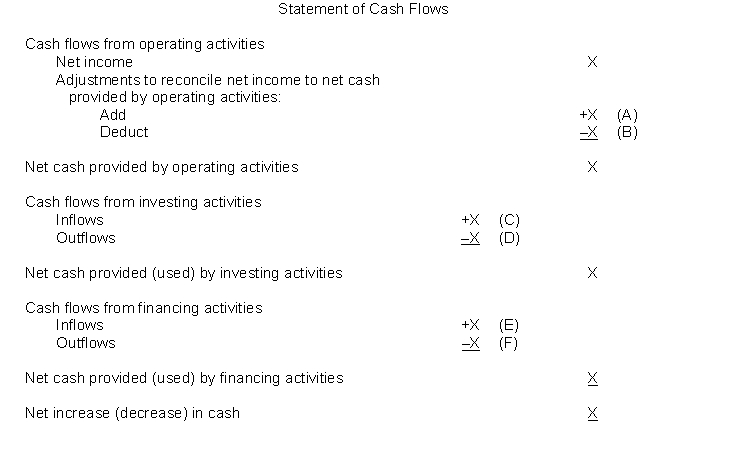

Classification of cash flows.Note that X in the following statement of cash flows identifies a dollar amount and the letters (A) through (F) identify specific items which appear in the major sections of the statement prepared using the indirect method.

InstructionsFor each of the following items, indicate by letter in the blank spaces below, the section or sections where the effect would be reported. Use the code (A through F) from above. If the item is not required to be reported on the statement of cash flows, write the word "none" in the blank. Assume that generally accepted accounting principles have been followed in determining net income and that there are no short-term securities which are considered cash equivalents. 1. After the retirement of an officer, the insurance policy was canceled, and a cash settlement was received by the firm. These proceeds were in excess of the book value of the policy. 2. Sales discounts lapsed and not taken by customers. (Sales are recorded at net originally.) 3. Accrued estimated income taxes for the period. These taxes will be paid next year. 4. Amortization of premium on bonds payable. 5. Premium amortized on investment in bonds. 6. The book value of trading securities was reduced to fair value. 7. Purchase of available-for-sale securities. 8. Declaration of stock dividends (not yet issued). 9. Issued preferred stock in exchange for equipment. 10. Bad debts (under allowance method) estimated and recorded for the period (receivables classified as current). 11. Gain on disposal of old machinery. 12. Payment of cash dividends (previously declared in a prior period). 13. Trading securities are sold at a loss. 14. Two-year notes issued at discount for a patent. 15. Amortization of Discount on Notes Receivable (long-term). 16. Decrease in Retained Earnings Appropriated for Self-insurance.

Definitions:

1985 RULPA

The Revised Uniform Limited Partnership Act of 1985, a set of laws adopted by various states in the U.S. to govern the formation, operation, and dissolution of limited partnerships.

Uniform Partnership Act

A set of laws adopted by states in the United States to govern the formation, operation, and dissolution of partnerships.

Limited Liability

Limited liability is a legal structure that restricts an investor's or owner's loss to the amount invested, protecting personal assets from business debts and claims.

Limited Partners

Investors in a limited partnership who contribute capital but have limited liabilities and are not involved in day-to-day management of the business.

Q1: Because of improvements in forecasting techniques, estimating

Q8: Once a firm has defined its purpose,

Q9: Ross Financial has suffered losses in recent

Q28: Which of the following factors should be

Q46: Anderson Systems is considering a project that

Q64: Presented below is information related to

Q68: The amount that Nobel should record as

Q87: Dyke Company's net incomes for the past

Q106: The methods of accounting for a lease

Q109: Cashman Company reported net income of $265,000