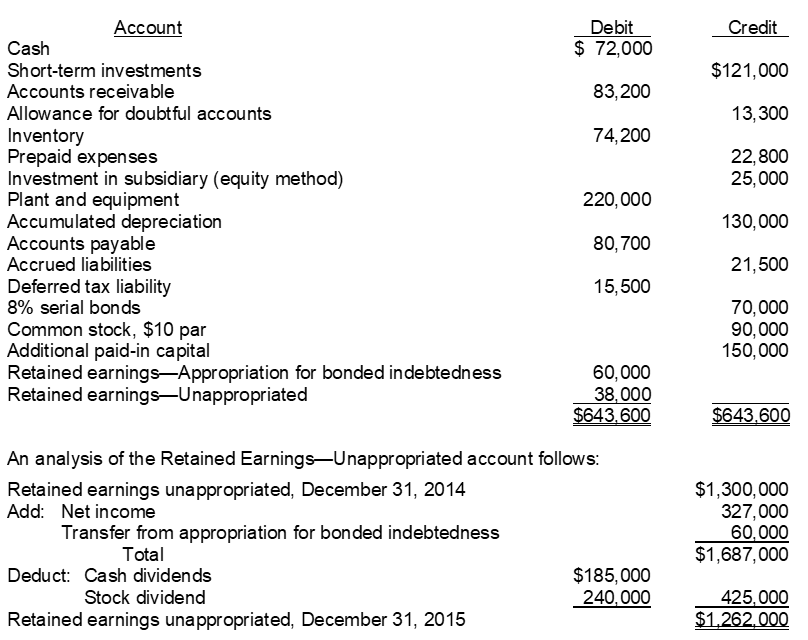

The net changes in the balance sheet accounts of Keating Corporation for the year 2015 are shown below.

1. On January 2, 2015 short-term investments (classified as available-for-sale) costing $121,000 were sold for $155,000.

2. The company paid a cash dividend on February 1, 2015.

3. Accounts receivable of $16,200 and $19,400 were considered uncollectible and written off in 2015 and 2014, respectively.

4. Major repairs of $33,000 to the equipment were debited to the Accumulated Depreciation account during the year. No assets were retired during 2015.

5. The wholly owned subsidiary reported a net loss for the year of $20,000. The loss was recorded by the parent.

6. At January 1, 2015, the cash balance was $166,000.

Instructions

Prepare a statement of cash flows (indirect method) for the year ended December 31, 2015. Keating Corporation has no securities which are classified as cash equivalents.

Definitions:

Partnership

A business structure where two or more individuals manage and operate a business in accordance with the terms and objectives set out in a Partnership Deed.

Legal Status

The standing of an entity or individual under the law, determining their rights, responsibilities, and liabilities.

Volunteer Work

involves performing tasks or providing services for the benefit of others or the community, without financial compensation.

Partnership Property

Assets co-owned by partners in a business partnership, where each partner has an interest in these assets in relation to their investment or agreement.

Q6: In its 2015 income statement, what amount

Q11: Counterbalancing errors do not include<br>A) errors that

Q29: It is extremely difficult to estimate the

Q31: The amount of AOCI (net gain) amortized

Q38: A benefit of leasing to the lessor

Q39: The book value of the buildings and

Q43: In cash flow estimation, the existence of

Q62: Which of the following statements is CORRECT?<br>A)

Q69: The NPV method's assumption that cash inflows

Q86: In a statement of cash flows, what