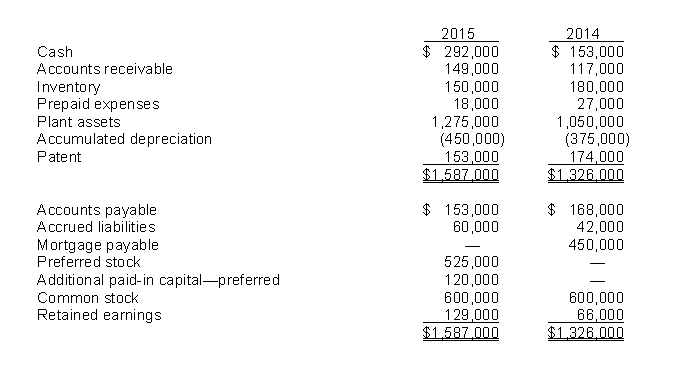

Hartman, Inc. has prepared the following comparative balance sheets for 2014 and 2015:

1. The Accumulated Depreciation account has been credited only for the depreciation expense for the period.

2. The Retained Earnings account has been charged for dividends of $148,000 and credited for the net income for the year.

The income statement for 2015 is as follows:

Instructions

(a) From the information above, prepare a statement of cash flows (indirect method) for Hartman, Inc. for the year ended December 31, 2015.

(b) From the information above, prepare a schedule of cash provided by operating activities using the direct method.

Definitions:

Percentage of Sales Approach

A method used in financial forecasting to estimate various elements of a financial statement as a percentage of forecasted sales.

Profit Margin

A financial metric that measures the amount of net income generated as a percentage of revenue, indicating how effectively a company can convert sales into net profits.

Dividend Payout Ratio

The percentage of earnings paid to shareholders in dividends, indicating how much money a company returns to shareholders versus reinvesting in the business.

Financial Planning Models

Tools or software used for projecting future financial results and for strategic financial planning, often in the form of spreadsheets or specialized software.

Q8: Which of the following statements is CORRECT?<br>A)

Q23: Which of the following statements is CORRECT?

Q24: IFRS requires companies to prepare interim reports

Q25: Executory costs should be excluded by the

Q29: The following information is related to

Q32: Whited Products recently completed a 4-for-1 stock

Q33: The net cash provided (used) by financing

Q122: At the end of 2015, which of

Q124: Wave, Inc. follows IFRS for its external

Q133: When a company amends its defined benefit