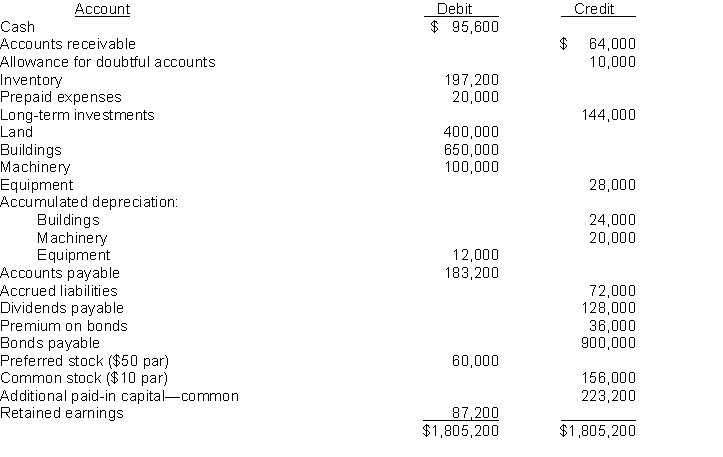

The net changes in the balance sheet accounts of Eusey, Inc. for the year 2015 are shown below:  Additional information:

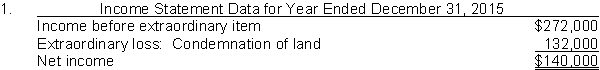

Additional information:  2. Cash dividends of $128,000 were declared December 15, 2015, payable January 15, 2016. A 5% stock dividend was issued March 31, 2015, when the market value was $22.00 per share.3. The long-term investments were sold for $140,000.4. A building and land which cost $480,000 and had a book value of $350,000 were sold for $400,000. The cost of the land, included in the cost and book value above, was $20,000.

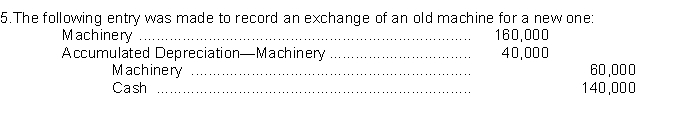

2. Cash dividends of $128,000 were declared December 15, 2015, payable January 15, 2016. A 5% stock dividend was issued March 31, 2015, when the market value was $22.00 per share.3. The long-term investments were sold for $140,000.4. A building and land which cost $480,000 and had a book value of $350,000 were sold for $400,000. The cost of the land, included in the cost and book value above, was $20,000.  6. A fully depreciated copier machine which cost $28,000 was written off.7. Preferred stock of $60,000 par value was redeemed for $80,000.8. The company sold 12,000 shares of its common stock ($10 par) on June 15, 2015 for $25 a share. There were 87,600 shares outstanding on December 31, 2015.9. Bonds were sold at 104 on December 31, 2015."10. Land that was condemned had a book value of $240,000.

6. A fully depreciated copier machine which cost $28,000 was written off.7. Preferred stock of $60,000 par value was redeemed for $80,000.8. The company sold 12,000 shares of its common stock ($10 par) on June 15, 2015 for $25 a share. There were 87,600 shares outstanding on December 31, 2015.9. Bonds were sold at 104 on December 31, 2015."10. Land that was condemned had a book value of $240,000.

InstructionsPrepare a statement of cash flows (indirect method). Ignore tax effects."

Definitions:

Sexually Transmitted Infections

Infections that are primarily passed through sexual contact, including viruses, bacteria, and parasites.

Extroverts

Individuals who are outgoing, sociable, and often derive energy from interactions with others.

Celibacy

The state of abstaining from marriage and sexual relations, often for religious or spiritual reasons.

Lucrative Job

A job or employment that is highly profitable and provides a significant financial return or benefit.

Q4: The total lease-related expenses recognized by the

Q22: In a defined-contribution plan, a formula is

Q30: Recognition of tax benefits in the loss

Q35: If the financial statements examined by an

Q45: Yancey, Inc. would record depreciation expense on

Q60: Masulis Inc. is considering a project that

Q66: The gross profit amount in a sales-type

Q83: A company can convert net income to

Q96: If Benjamin Company and Iris, Inc. are

Q136: Presented below is pension information for