Use the following information for questions 44 and 45.

Dream Home Inc., a real estate developing company, was accounting for its long-term contracts using the completed contract method prior to 2015. In 2015, it changed to the percentage-of-completion method.

The company decided to use the same for income tax purposes. The tax rate enacted is 40%.

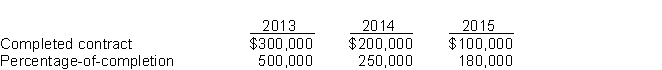

Income before taxes under both the methods for the past three years appears below.

-What amount will be debited to Construction in Process account, to record the change at beginning of 2015?

Definitions:

Q6: In a statement of cash flows, the

Q15: Ingram Electric Products is considering a project

Q19: Zook Incorporated, had net income for

Q32: Which of the following is not accounted

Q33: Metcalf Company leases a machine from Vollmer

Q40: During 2015, Stout Inc. had the following

Q41: Murphy Company purchased equipment for $300,000 on

Q43: Clayton Industries is planning its operations for

Q97: During 2015, Orton Company earned net

Q120: In a defined-benefit plan, the process of