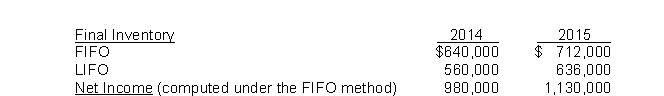

Heinz Company began operations on January 1, 2014, and uses the FIFO method in costing its raw material inventory. Management is contemplating a change to the LIFO method and is interested in determining what effect such a change will have on net income. Accordingly, the following information has been developed:  Based on the above information, a change to the LIFO method in 2015 would result in net income for 2015 of

Based on the above information, a change to the LIFO method in 2015 would result in net income for 2015 of

Definitions:

Q2: Hindelang Inc. is considering a project that

Q25: A firm that bases its capital budgeting

Q27: The phenomenon called "multiple internal rates of

Q39: Chua Chang & Wu Inc. is planning

Q39: During 2015, Quirk, Incorporated purchased $3,500,000 of

Q57: When a company adopts a pension plan,

Q77: For a sales-type lease,<br>A) the sales price

Q85: Stern Associates is considering a project that

Q91: When a change in the tax rate

Q93: Which of the following statements is CORRECT?