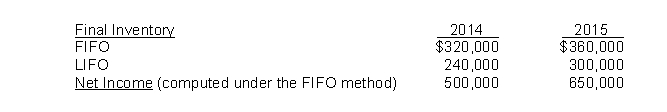

Lanier Company began operations on January 1, 2014, and uses the FIFO method in costing its raw material inventory. Management is contemplating a change to the LIFO method and is interested in determining what effect such a change will have on net income. Accordingly, the following information has been developed:  Based upon the above information, a change to the LIFO method in 2015 would result in net income for 2015 of

Based upon the above information, a change to the LIFO method in 2015 would result in net income for 2015 of

Definitions:

Insolvent

Refers to a financial state where an entity cannot meet its debt obligations as they come due.

Obligations

A legal or financial duty that an entity is required to fulfill, such as debt repayment or service delivery.

Liabilities With Priority

Obligations of a business that are given precedence over other debts, especially in the context of bankruptcy or liquidation proceedings.

Q26: On December 31, 2015, Grantham, Inc. appropriately

Q26: A statement of cash flows prepared according

Q27: The phenomenon called "multiple internal rates of

Q54: Cornell Enterprises is considering a project that

Q61: In 2014, Sauder should record interest expense

Q75: Accounting errors include changes in estimates that

Q76: IFRS does not provide detailed guidance for

Q85: The projected benefit obligation is the measure

Q102: Assume that the direct effects of this

Q107: Rossi Company has a defined-benefit plan.