Use the following information for questions 55 and 56.

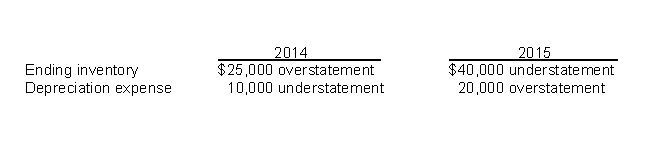

Armstrong Inc. is a calendar-year corporation. Its financial statements for the years ended 12/31/14 and 12/31/15 contained the following errors:

-Assume that the 2014 errors were not corrected and that no errors occurred in 2013. By what amount will 2014 income before income taxes be overstated or understated?

Definitions:

Balance Sheet

A balance sheet is a financial statement that showcases an organization's assets, liabilities, and shareholders' equity at a specific point in time, providing a snapshot of its financial condition.

U.S. Dollars

The official currency of the United States, widely used as a benchmark and standard for international financial transactions.

Translation Adjustment

An accounting entry that arises when converting financial statements of foreign subsidiaries into the parent company's reporting currency, affecting comprehensive income.

Functional Currency

The currency of the primary economic environment in which an entity operates, generally the currency in which it primarily generates and expends cash.

Q4: IFRS requires which of the following disclosures

Q26: A statement of cash flows prepared according

Q29: The following information is related to

Q29: The distinction between a direct-financing lease and

Q30: Recognition of tax benefits in the loss

Q48: Counterbalancing errors are those errors that take

Q50: Under the direct method, the total taxes

Q113: Net cash flow from operating activities

Q117: The balance in the Retained Earnings account

Q127: Indicate and explain whether each of the