Use the following information for questions 57 through 59.

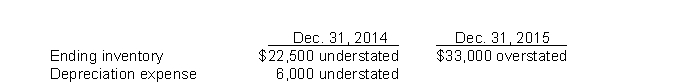

Langley Company's December 31 year-end financial statements contained the following errors:  An insurance premium of $54,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The prepayment was recorded with a debit to insurance expense. In addition, on December 31, 2015, fully depreciated machinery was sold for $28,500 cash, but the sale was not recorded until 2016. There were no other errors during 2015 or 2016 and no corrections have been made for any of the errors. Ignore income tax considerations.

An insurance premium of $54,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The prepayment was recorded with a debit to insurance expense. In addition, on December 31, 2015, fully depreciated machinery was sold for $28,500 cash, but the sale was not recorded until 2016. There were no other errors during 2015 or 2016 and no corrections have been made for any of the errors. Ignore income tax considerations.

-What is the total net effect of the errors on Langley's 2015 net income?

Definitions:

Company Officers

Individuals appointed by the board of directors who manage the daily operations of a company, such as the CEO, CFO, and COO.

Loans

Borrowed money that must be repaid, typically with interest, according to agreed terms and conditions.

Percentage

A proportion or share in relation to a whole, represented as a number out of 100.

Receivables Basis

An accounting method that recognizes revenue when related receivables are actually or constructively received.

Q13: Donnegan Company reported operating expenses of

Q18: When evaluating a new project, firms should

Q18: Ignoring income taxes, the amount of expense

Q51: Preparation of statement of cash flows (format

Q60: Companies should report accounting transactions as they

Q65: Under the installment-sales method, companies defer revenue

Q66: The amount to be shown on the

Q77: Advertising costs may be accrued or deferred

Q105: Which of the following is true of

Q122: What is the amount of profit on