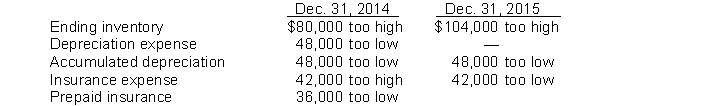

Joseph Co. began operations on January 1, 2014. Financial statements for 2014 and 2015 contained the following errors:  In addition, on December 26, 2015 fully depreciated equipment was sold for $48,000, but the sale was not recorded until 2016. No corrections have been made for any of the errors.

In addition, on December 26, 2015 fully depreciated equipment was sold for $48,000, but the sale was not recorded until 2016. No corrections have been made for any of the errors.

InstructionsIgnoring income taxes, show your calculation of the total effect of the errors on 2015 net income.

Definitions:

Compound Return

The rate of return on an investment over a specified period, taking into account the effect of compounding, where the investment's earnings, from either capital gains or interest, are reinvested to generate additional earnings over time.

Geometric Average

A method of calculating the average rate of return of a set of values by multiplying them together and taking the nth root, where n is the number of values.

Efficient Capital Market

A market in which securities' prices fully reflect all available information, making it impossible to consistently achieve higher returns without taking additional risks.

Q1: When there is a significant increase in

Q17: Nagel Co.'s prepaid insurance was $95,000 at

Q33: Metcalf Company leases a machine from Vollmer

Q34: Revenues are realized when a company exchanges

Q57: Inventory and cost of goods sold at

Q68: Surf Company follows IFRS for its

Q69: The NPV method's assumption that cash inflows

Q87: Which of the following statements is CORRECT?<br>A)

Q90: Selected Information about the pension plan of

Q128: Krause Company on January 1, 2015, enters