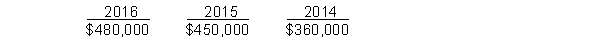

Dyke Company's net incomes for the past three years are presented below:  During the 2016 year-end audit, the following items come to your attention:1. Dyke bought equipment on January 1, 2013 for $392,000 with a $32,000 estimated salvage value and a six-year life. The company debited an expense account and credited cash on the purchase date for the entire cost of the asset. (Straight-line method)"2. During 2016, Dyke changed from the straight-line method of depreciating its cement plant to the double-declining balance method. The following computations present depreciation on both bases:

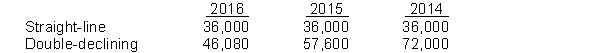

During the 2016 year-end audit, the following items come to your attention:1. Dyke bought equipment on January 1, 2013 for $392,000 with a $32,000 estimated salvage value and a six-year life. The company debited an expense account and credited cash on the purchase date for the entire cost of the asset. (Straight-line method)"2. During 2016, Dyke changed from the straight-line method of depreciating its cement plant to the double-declining balance method. The following computations present depreciation on both bases:  The net income for 2016 was computed using the double-declining balance method, on the January 1, 2016 book value, over the useful life remaining at that time. The depreciation recorded in 2016 was $72,000.""3. Dyke, in reviewing its provision for uncollectibles during 2014, has determined that 1% is the appropriate amount of bad debt expense to be charged to operations. The company had used 1/2 of 1% as its rate in 2015 and 2016 when the expense had been $18,000 and $12,000, respectively. The company recorded bad debt expense under the new rate for 2016. The company would have recorded $6,000 less of bad debt expense on December 31, 2016 under the old rate.

The net income for 2016 was computed using the double-declining balance method, on the January 1, 2016 book value, over the useful life remaining at that time. The depreciation recorded in 2016 was $72,000.""3. Dyke, in reviewing its provision for uncollectibles during 2014, has determined that 1% is the appropriate amount of bad debt expense to be charged to operations. The company had used 1/2 of 1% as its rate in 2015 and 2016 when the expense had been $18,000 and $12,000, respectively. The company recorded bad debt expense under the new rate for 2016. The company would have recorded $6,000 less of bad debt expense on December 31, 2016 under the old rate.

Instructions

(a) Prepare in general journal form the entry necessary to correct the books for the transaction in part 1 of this problem, assuming that the books have not been closed for the current year.

(b) Compute the net income to be reported each year 2014 through 2016.

(c) Assume that the beginning retained earnings balance (unadjusted) for 2014 was $1,260,000. At what adjusted amount should this beginning retained earnings balance for 2014 be stated, assuming that comparative financial statements were prepared?(d) Assume that the beginning retained earnings balance (unadjusted) for 2016 is $1,800,000 and that non-comparative financial statements are prepared. At what adjusted amount should this beginning retained earnings balance be stated?"

Definitions:

Service Providers

Companies or individuals that offer services to others in exchange for payment.

Delivery Gap

The discrepancy between a company’s service quality specification and the actual service delivered to customers, often leading to customer dissatisfaction.

Communication Gap

A type of service gap; refers to the difference between the actual service provided to customers and the service that the firm’s promotion program promises.

Communication Gap

The difference or misunderstanding that occurs when the message sent is not interpreted by the receiver in the way that the sender intended.

Q9: Under IFRS, a deferred tax liability is

Q15: Langston Labs has an overall (composite) WACC

Q16: Income from an investment in common stock

Q24: Is the following exception applicable to IFRS

Q38: Net cash flow from operating activities

Q57: When a company adopts a pension plan,

Q82: Both the regular and the modified IRR

Q92: Presented below is information related to

Q111: How should significant noncash transactions be reported

Q124: IFRS for leases is more "rules-based" than