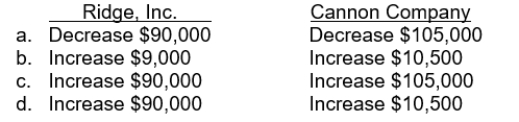

Ridge, Inc. follows IFRS for its external financial reporting, and Cannon Company follows U.S. GAAP for its external financial reporting. During 2015, both companies changed depreciation methods, from double-declining balance to straight-line. Compared to double-declining balance, for Ridge, Inc. the change resulted in a decrease in reported depreciation expense of $90,000, and for Cannon Company the change resulted in a reported decrease in depreciation expense of $105,000. The remaining useful lives of the assets impacted by the change in depreciation method is 10 years for both companies. How would this change impact the net income reported by Ridge, Inc. and Cannon Company for the year ended December 31, 2015?

Definitions:

Location of Rock

The specific geographical placement or setting where a rock formation is found.

Mudflow Deposits

Sediments left behind by mudflows, which are fast-moving flows of water and volcanic material or other sediment that can bury landscapes and structures.

Landslide Blocks

Large pieces of rock or soil that have moved down a slope in a mass movement event, often due to gravity or seismic activity.

Location of Rock

The specific geological setting or area where a rock type is found or originates from.

Q8: Which of the following statements is CORRECT?<br>A)

Q32: Under the accrual basis of accounting, net

Q48: In a lease that is recorded as

Q50: An operating segment is a reportable segment

Q53: Jarvis, Inc. reported net income of

Q78: Lindsay Corporation had net income for

Q81: Geary Co. leased a machine to Dains

Q89: A pension plan is contributory when the

Q116: The relationship between the amount funded and

Q129: The cost-recovery method<br>A) is prohibited under current