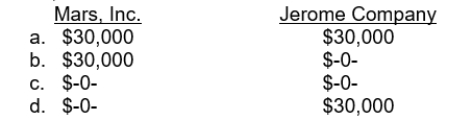

Mars, Inc. follows IFRS for its external financial reporting, while Jerome Company uses U.S. GAAP for its external financial reporting. During the year ended December 31, 2015, both companies changed from using the completed-contract method of revenue recognition for long-term construction contracts to the percentage-of-completion method. Both companies experienced an indirect effect, related to increased profit-sharing payments in 2015, of $30,000. As a result of this change, how much expense related to the profit-sharing payment must be recognized by each company on the income statement for the year ended December 31, 2015?

Definitions:

Monopoly Power

The ability of a monopoly (a single seller in the market) to control market prices for its product or service, often resulting in higher prices and lower output than in competitive markets.

Public Education

Public education refers to the schooling system that is financed and operated by government agencies to provide free education to all students.

Wealth Distribution

The manner in which wealth is shared among the members of a community or society.

Income Inequality

The uneven distribution of income within a population, leading to disparities in wealth and economic opportunities.

Q1: When there is a significant increase in

Q16: Income from an investment in common stock

Q26: Which of the following statements is CORRECT?<br>A)

Q32: Emporia Corporation is a lessee with a

Q36: Which of the following is an advantage

Q37: Horner Corporation has a deferred tax asset

Q50: Which of the following statements is CORRECT?

Q55: What is the amount of the minimum

Q86: In a statement of cash flows, what

Q115: An employer does not have to report