Use the following information for questions 44 and 45.

Dream Home Inc., a real estate developing company, was accounting for its long-term contracts using the completed contract method prior to 2015. In 2015, it changed to the percentage-of-completion method.

The company decided to use the same for income tax purposes. The tax rate enacted is 40%.

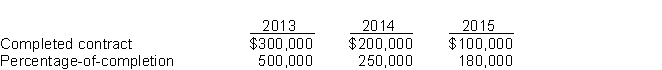

Income before taxes under both the methods for the past three years appears below.

-What amount will be debited to Construction in Process account, to record the change at beginning of 2015?

Definitions:

Urine Production

The process by which the kidneys filter the blood, removing waste products and excess substances to form urine.

Angiotensinogen

A glycoprotein produced by the liver that is the precursor to angiotensin, playing a key role in blood pressure regulation.

Angiotensin I

Peptide derived when renin acts on angiotensinogen.

Renin

An enzyme secreted by the kidneys that plays a crucial role in the body's regulation of blood pressure.

Q13: Presented below are four segments that

Q14: The return on common stock equity for

Q26: Accounting for income taxes can result in

Q30: Alternative methods exist for the measurement of

Q32: Project X's IRR is 19% and Project

Q46: Computation of selected ratios.The following data is

Q49: Which of the following subsequent events (post-balance-sheet

Q93: The MD&A section must provide information about

Q96: Which of the following describes a change

Q116: What amount of cash was collected from