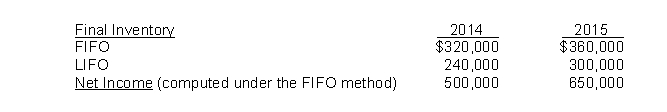

Lanier Company began operations on January 1, 2014, and uses the FIFO method in costing its raw material inventory. Management is contemplating a change to the LIFO method and is interested in determining what effect such a change will have on net income. Accordingly, the following information has been developed:  Based upon the above information, a change to the LIFO method in 2015 would result in net income for 2015 of

Based upon the above information, a change to the LIFO method in 2015 would result in net income for 2015 of

Definitions:

Fixed Expenses

Expenses that do not change with the level of production or business activity, such as rent, salaries, and insurance premiums.

Departmental Cost Analysis

The process of evaluating and breaking down the costs associated with each department within an organization, facilitating budgeting and efficiency improvements.

Direct Costs

Direct costs are expenses that can be directly traced to the production of a specific good or service, without any allocation.

Delivery Expenses

Costs associated with the transport of goods from the seller to the buyer, which can include freight, packaging, and handling fees.

Q8: The amount to be shown on the

Q27: Trade loading is a practice through which

Q43: Perez Company's net accounts receivable were $800,000

Q45: Suppose Walker Publishing Company is considering bringing

Q58: Typically, a project will have a higher

Q62: When preparing a statement of cash flows

Q67: On January 2, 2014, Gold Star Leasing

Q76: A financial projection is a set of

Q88: Assuming that Wilcox elects to use the

Q104: The net cash provided (used) by financing