Use the following information for questions 57 through 59.

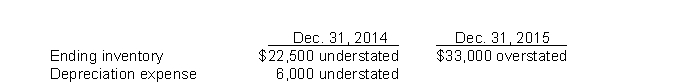

Langley Company's December 31 year-end financial statements contained the following errors:  An insurance premium of $54,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The prepayment was recorded with a debit to insurance expense. In addition, on December 31, 2015, fully depreciated machinery was sold for $28,500 cash, but the sale was not recorded until 2016. There were no other errors during 2015 or 2016 and no corrections have been made for any of the errors. Ignore income tax considerations.

An insurance premium of $54,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The prepayment was recorded with a debit to insurance expense. In addition, on December 31, 2015, fully depreciated machinery was sold for $28,500 cash, but the sale was not recorded until 2016. There were no other errors during 2015 or 2016 and no corrections have been made for any of the errors. Ignore income tax considerations.

-What is the total net effect of the errors on Langley's 2015 net income?

Definitions:

Product Costs

Costs directly associated with the production of goods, including materials, labor, and overhead expenses.

Inventoriable Costs

These are costs associated with the acquisition or production of goods, which are initially recorded as inventory on the balance sheet and expensed as cost of goods sold when the goods are sold.

Direct Costs

Expenses that can be directly linked to the production of specific goods or services, such as materials and labor.

Cost of Goods Manufactured

The total expense incurred in manufacturing products during a specific period, including labor, materials, and overhead costs.

Q11: Counterbalancing errors do not include<br>A) errors that

Q35: On the statement of cash flows (indirect

Q38: A benefit of leasing to the lessor

Q39: Munoz Corp.'s books showed pretax financial income

Q43: In cash flow estimation, the existence of

Q46: Temple Corp. is considering a new project

Q70: The primary advantage to using accelerated rather

Q72: Four of the following statements are truly

Q99: Benjamin Company uses IFRS, while Iris, Inc.

Q130: Companies report the cash flows from purchases