Use the following information for questions 57 through 59.

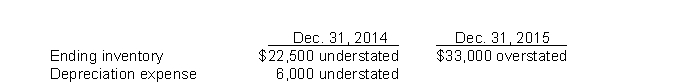

Langley Company's December 31 year-end financial statements contained the following errors:  An insurance premium of $54,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The prepayment was recorded with a debit to insurance expense. In addition, on December 31, 2015, fully depreciated machinery was sold for $28,500 cash, but the sale was not recorded until 2016. There were no other errors during 2015 or 2016 and no corrections have been made for any of the errors. Ignore income tax considerations.

An insurance premium of $54,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The prepayment was recorded with a debit to insurance expense. In addition, on December 31, 2015, fully depreciated machinery was sold for $28,500 cash, but the sale was not recorded until 2016. There were no other errors during 2015 or 2016 and no corrections have been made for any of the errors. Ignore income tax considerations.

-What is the total effect of the errors on the balance of Langley's retained earnings at December 31, 2015?

Definitions:

Progesterone

A steroid hormone released by the corpus luteum in the ovary, essential for maintaining pregnancy and regulating the menstrual cycle.

Reproductive Tract

The series of organs and ducts through which gametes travel and where fertilization, gestation, and childbirth occur, differing in structure between males and females.

Ectopic Pregnancy

A pregnancy where the fertilized egg implants and grows outside the main cavity of the uterus, often in a fallopian tube.

Ejaculation

The forceful expulsion of semen from the body, typically occurring as a climax of sexual arousal.

Q1: Accrued salaries payable of $51,000 were not

Q1: Conflicts between two mutually exclusive projects occasionally

Q14: An objective of the statement of cash

Q49: A loss in the current period on

Q58: Segment reporting.Finney Company's condensed income statement is

Q79: What is the amount of the total

Q85: Discuss the accounting procedures for and illustrate

Q101: Management's discussion and analysis section covers three

Q103: On December 31, 2015, special insurance costs,

Q111: Minimum lease payments may include a<br>A) penalty