Use the following information for questions 61 through 63.

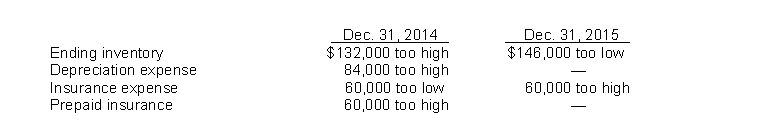

Bishop Co. began operations on January 1, 2014. Financial statements for 2014 and 2015 con- tained the following errors:  In addition, on December 31, 2015 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2016. No corrections have been made for any of the errors. Ignore income tax considerations.

In addition, on December 31, 2015 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2016. No corrections have been made for any of the errors. Ignore income tax considerations.

-The total effect of the errors on the balance of Bishop's retained earnings at December 31, 2015 is understated by

Definitions:

Zero Coupon Bond

A debt security that does not pay interest but is traded at a deep discount, offering profit at maturity when it is redeemed for its face value.

Face Value

The nominal value printed on a financial instrument like a bond or stock certificate, not necessarily its market value.

Interest Rate

The interest rate is the proportion, typically expressed as a percentage, at which interest is paid by borrowers for the use of money that they borrow from a lender.

Present Discounted Value

The immediate value of a forthcoming sum of money or cash flow streams, discounted at a specific rate of return.

Q1: Accrued salaries payable of $51,000 were not

Q11: The installment-sales method of recognizing profit for

Q19: Deferred tax amounts that are related to

Q40: Last year Jain Technologies had $250 million

Q53: Which of the following statements is CORRECT?<br>A)

Q88: Assuming that Wilcox elects to use the

Q90: Under the completed-contract method<br>A) revenue, cost, and

Q100: What is the amount of depreciation expense

Q111: The FASB makes it mandatory to use

Q130: Companies report the cash flows from purchases